About Us

The Global Emerging Markets Risk Database (GEMs) is the world’s largest credit risk database for emerging markets. GEMs is a joint initiative of multilateral development banks (MDBs) and development finance institutions (DFIs) that pools credit risk data on their lending operations in Emerging Markets and Developing Economies (EMDEs) and provides members and the public with the related statistics. The GEMs Consortium was created in 2009 on the initiative of the European Investment Bank (EIB) and the International Finance Corporation (IFC) and has evolved into a community of practice that develops common approaches and data methodologies to record default and recovery frequencies for the member MDBs and DFIs.

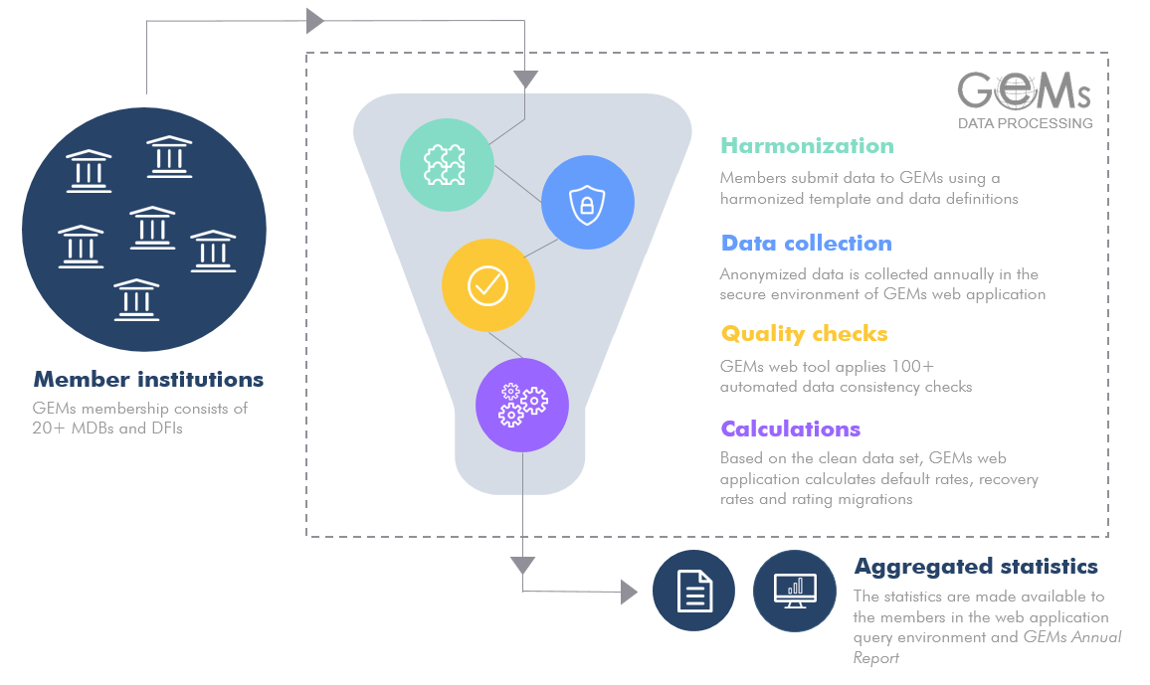

The GEMs database includes data from the member institutions, which are the 29 largest MDBs and DFIs. GEMs member institutions work closely together to produce reliable credit risk statistics on public, private, sovereign and sovereign-guaranteed lending across their portfolios.

The member institutions contribute anonymized data on their projects’ credit events notably in emerging markets and developing economies. In return, members gain access to aggregate GEMs statistics on observed default rates, rating migration matrixes and recovery rates by geography, sector, time-period and various other dimensions.

GEMs statistics thus provide members with an insight into geographies that are otherwise relatively poorly served in terms of empirical credit information.

For lower income countries, fragile and conflict states and frontier markets, GEMs in many cases contains the most exhaustive database of credit data, both in number of data points and length of coverage. The consortium members apply the GEMs statistics in their various internal risk management processes, such as benchmarking, provisioning estimates, probability of default (PD) and loss given default (LGD) models calibration, regulatory and economic capital calculations and the validation on PD & LGD assumptions.

GEMs is governed by a Steering Committee, co-chaired by the European Investment Bank Group and the World Bank Group. The Committee represents the interests of GEMs Consortium members and defines the strategic and operational priorities.

The GEMs Secretariat is hosted by the European Investment Bank in Luxembourg and manages the day-to-day operations of the Consortium.

Current GEMs membership stands at 29. For information about joining the GEMs Consortium, please contact us. For more information about GEMs, read our Frequently Asked Questions.

OUR GUIDING PRINCIPLES

Cooperation

GEMs is not only a data-driven cooperation among peer institutions but also offers a forum for discussion and exchange among experts. It is a concrete example of how MDBs and DFIs can work together as a system to collectively achieve more than they could do alone – improving risk management practices across the IFI industry by exchanging on methodology topics and pooling data.

Confidentiality

The GEMs cooperation is based on a strict confidentiality agreement. The consortium has jointly developed an anonymized data collection process and methodology which supports the protection data confidentiality and allows for the generation of output statistics on the consortium level.

Data Quality

The GEMs methodology and data process, developed over more than 10 years now, ensures data harmonisation and a high level of data quality. The complete GEMs historical dataset is submitted annually leading to updates to previous data and addition of new data. Thus, over time, data quality continuously improves.

DATA COLLECTION AND REPORTING